Credit scores are the backbone of all the lending and borrowing that goes on in our economy. They influence whether you’ll get a mortgage, credit card, or any other type of loan – including financing for commercial vehicles, especially if you’re a sole trader or small business owner.

A good credit score can help you save money on interest rates and get better terms on loans. A bad credit score, on the other hand, can cost you time (and money). Or worse, it can prevent you from getting any financing at all, even if you’ve got solid money coming in through a current job or you have work lined up, waiting to go.

That’s why it’s important to know what factors go into making up your credit score, so you can improve it if necessary.

Your credit score is determined by a number of factors

The first step is to understand what a credit score is and how it’s calculated.

Your credit score is a number that’s calculated based on the information in your credit report.

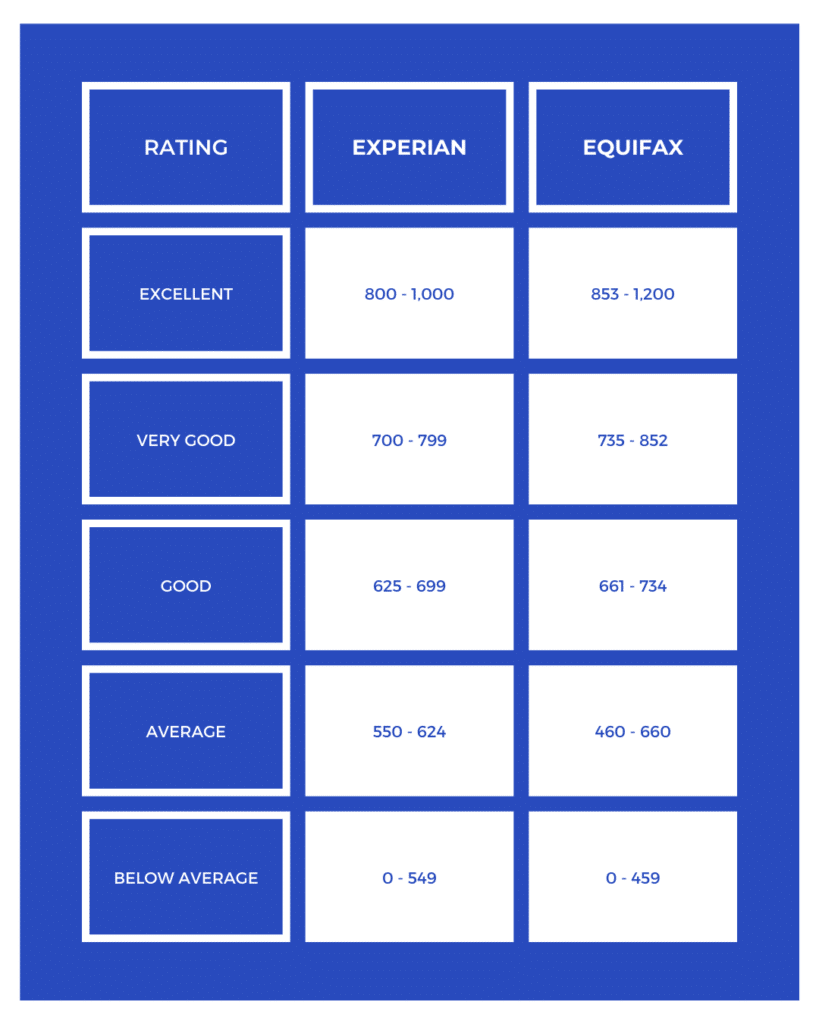

There are three credit bureaus that calculate your credit score – Equifax, Experian, and Illion – and they give you a result that sits somewhere on a scale between 0 and 1,200.

The higher your score, the more likely you are to receive credit (and get it at a lower interest rate).

Examples of credit

‘Credit’ comes in different types, such as:

- Credit cards

- Loans – personal loans (secured and unsecured), car loans, home loans (mortgage), business loans, student loans, and more

- Short-term or ‘pay day’ loans

- Buy Now Pay Later services

- A mobile phone

- Services such as electricity, gas, or water

Knowing all the things that constitute ‘credit’, helps you understand how your history of making payments on time for these things influences your credit score.

So how is your credit score calculated?

While the credit bureaus won’t reveal their exact formula for calculating credit scores, various factors have been shown to influence their calculations including, but not limited to:

- The types of credit you have

- How long you’ve held each type of account open

- How much money is owed on loans or credit cards

- How much of your credit limit is used

- How long it’s been since you last paid a bill

- Whether you have multiple lines of credit

- How many credit applications you’ve made in the past five years

- If someone else defaults on a joint debt

- Court judgements

- Bankruptcies

- Serious credit infringements

- How many late payments you have on record (payment history)

While all of these play a role, the last one – payment history – often carries the most weight.

Payment history

Payment history often accounts for the most significant part of your credit score. Your payment history is what lenders use to determine how reliable you are when it comes to making payments on time.

Payment history can be broken down into two components:

- How you’ve paid every bill over the past few years (your payment behaviour)

- How long it takes you from when a bill is due, until it’s paid off in full (the payment cycle)

Payment behaviour refers to how consistently you make payments on time each month or year. You may want to set up reminders that prompt you to pay on time, or even automate this process so that there are no surprises when bills are due.

If at all possible, try to avoid making late payments. However, if it happens once or twice in a row a handy thing to do is call your lender right away so they know what happened and don’t report it as a negative mark against your credit score.

The payment cycle refers to how long it takes you to pay off your bills in full. The thing to keep in mind is that paying off your entire balance – rather than just the minimum required – is often the quickest way to pay off your loan.

You can check your payment cycle by reviewing your statements online or calling your lender. Some lenders will let you choose how often you pay your bills each month, but most of the time it’s set up for you automatically. If you’re late on a payment, it can negatively impact your credit score.

What is a good credit score?

If you’re a sole trader or small business owner wanting to get a truck loan, van loan, or other types of commercial vehicle financing, then knowing what lenders consider a good credit score is important.

Credit scores differ between each of the bureaus, but are generally mapped out on a five-point scale – below average, average, good, very good, and excellent.

Here’s what that looks like for Experian and Equifax (two major credit reporting bureaus):

If you’re looking at these numbers and thinking that you’re not placed very well to get the commercial vehicle loan you’re after, then working on improving your score might be the way to go.

How to improve your credit score

While there’s no quick fix to improve your credit score – and it can’t be changed overnight – the good news is, working on it consistently can have a lot of positive impact.

A few of the important things you can do to improve your credit score:

Make repayments on time

As mentioned earlier, your payment history is a big factor in your credit score. For some people, it’s the most important factor. That’s why it’s crucial to ensure you make your repayments on time to help you improve your credit score.

Space out your applications for credit

Lenders look at your credit report when you apply for credit with them. This registers as a hard enquiry that shows on your report. If you’ve got multiple applications within a short amount of time, lenders and credit providers looking at your report might think you’re experiencing financial difficulty and reject you for a loan. That’s why spacing out your credit applications can work in your favour.

Where appropriate, keep credit accounts open

The length of your credit history is a factor in determining your credit score.

The longer you’ve had a credit account open, the more data there is to use to calculate your credit score – especially if it demonstrates that you can consistently handle a line of credit. So, where appropriate, and where it doesn’t cause you any financial distress, consider keeping the credit account open.

What if you need a work vehicle now and don’t have time to improve your credit score?

While you’re perfectly capable of taking the steps to fix your credit score and get the commercial vehicle financing you need, perhaps you just don’t have the time? Maybe you’ve got a job lined up, ready to go right now, but you need your own vehicle to do it.

The good news is ARG’s Rent To Buy solution is a leading alternative to commercial vehicle financing

It’s designed to quickly get you on the road and working, while also giving you a path towards buying the vehicle outright. And because there’s no need for financing, it means there’s no fuss around your credit score.

Find out more about ARG and how you can Rent To Buy the work vehicle you need.

Disclaimer: The information contained in this article is general in nature and does not take into account your personal objectives, financial situation or needs. Therefore, you should consider whether the information is appropriate to your circumstance before acting on it, and where appropriate, seek professional advice from a finance professional such as an adviser.