Whether you’re trying to start your own business, or looking for commercial vehicle financing for a business that’s already up and running, knowing your credit score is an important part of the process.

This guide will show you step by step how to do an online credit score check in Australia and give you all the information you need to do it today.

What is a credit score?

Your credit score is one of the most important factors in your financial life.

It’s a numerical representation of your creditworthiness and one of the main factors that lenders use to determine how likely you are to repay a loan.

In fact, if you’re looking for a truck loan, van loan, or any type of commercial vehicle financing, your lender will likely want to see your credit score before they lend you any money.

Some other things worth noting about your credit score:

- Credit scores are typically generated by credit bureaus, which are companies that collect and maintain information about people’s credit history.

- Credit scores are calculated using a variety of factors, including your payment history, any outstanding debt, the types of credit you have, how many credit applications you’ve made, the length of your credit history, and more.

- Credit scores aren’t fixed. They can change over time based on your credit behaviour. You can generally improve your credit score by making timely payments and keeping credit card balances low, while missing payments or maxing out credit cards is likely to lower your score.

- Credit scores are just one factor that lenders consider when making lending decisions. They may also look at other factors such as your income, employment history, and assets.

What’s the difference between a credit score, a credit rating, and a credit report?

The terms ‘credit score’, ‘credit rating’, and ‘credit report’ often get used interchangeably, but they’re actually different things:

- Your credit rating is the ‘range’ that your credit score sits inside (e.g. below average, good, excellent, etc.).

- Whereas your credit score is the exact numerical score (e.g. 758).

- And one, or both of these, are components of your overall credit report.

Aside from my credit score, what else is in my credit report?

When you apply for a loan or credit card, you provide your lender with an application. Your lender then pulls your credit report and credit score from Equifax, Experian, and Illion – the three major credit bureaus in Australia.

A full credit report generally includes:

- Your personal information – Details used to identify you, like your name, gender, date of birth, driver’s licence number, employer, addresses (current and previous).

- Your credit rating – A credit report includes your credit rating (the ‘range’ that your credit score sits inside) and may also include your credit score, but not all credit reporting agencies include both.

- Credit products – All the credit products you’ve held within the last 2 years including: the type of product (e.g. credit card, home loan, business loan, etc.), the credit provider, the credit limit, opening and closing account dates, and any joint applicant names.

- Repayment history – Each credit product you’ve held within the last 2 years including: repayment amounts, the repayment due dates, how often you made the payments (and if they were on time), and missed payments (and if/when they were made up).

- Credit applications – Credit you’ve previously applied for including: the number of applications you’ve made, the total amount of credit you’ve borrowed, and any loans that you’re the guarantor of.

- Any financial hardship information – Financial hardship arrangements for credit products can appear on your credit report. Only the months the arrangement is in place will show on your credit report. If the arrangement is permanent, the month the loan is varied will show. No other details are included.

- Any defaults – Defaults on utility bills, credit cards, and/or loans can show on your credit report. Defaults are ‘non-payments of a debt’ to a service provider, and the service provider may report these to a credit reporting agency, but they have to notify you first that they’re going to do so.

- Any adverse events – Any bankruptcies, debt agreements, court judgments, or personal insolvency agreements in your name are also listed in your credit report.

- Credit report requests – Every time a credit provider makes a request for your credit report, it registers on the credit report.

Your lender then compares your credit report and credit score to your past credit history, and uses a statistical formula to come up with a number that predicts how likely you are to repay your loan.

How do I know if I have a good credit score or a bad one?

Whether you’re a sole trader, an independent contractor, or a self-employed small business owner, a good credit score can help you in more ways than one. It can enable you to borrow more money, buy more items on credit, and access better loan options.

But what’s considered a good credit score depends on which credit reporting agency you ask, which lender or credit provider is assessing you, and what type of credit products you’re planning to access.

Each of the three main credit bureaus have slightly different ways of scoring your credit report, but all three generally use a five-point scale that plots your score somewhere inside one of the brackets shown in the table below:

| Equifax | Experian | Illion |

| Credit score: 853 – 1,200 Rating: Excellent ✅ | Credit score: 800 – 1,000 Rating: Excellent ✅ | Credit score: 800 – 1,000 Rating: Excellent ✅ |

| Credit score: 735 – 852 Rating: Very good ✅ | Credit score: 700 – 799 Rating: Very good ✅ | Credit score: 700 – 799 Rating: Great ✅ |

| Credit score: 661 – 734 Rating: Good ✅ | Credit score: 625 – 699 Rating: Good ✅ | Credit score: 500 – 699 Rating: Good ✅ |

| Credit score: 460 – 660 Rating: Average ⚠️ | Credit score: 550 – 624 Rating: Fair ⚠️ | Credit score: 300 – 499 Rating: Room for improvement ⚠️ |

| Credit score: 0 – 459 Rating: Below average ⚠️ | Credit score: 0 – 549 Rating: Below average ⚠️ | Credit score: 1 – 299 Rating: Low ⚠️ |

What information do I need to do a credit score check?

Before you dive into doing your credit score check, it’s worth getting a few things ready in advance to make sure the process flows as smoothly as possible…

1. Decide which credit reporting bureau you’d like to use

You can request your credit report from one, or all, of the credit reporting bureaus in Australia:

2. Prepare the documents you might be asked for

The documents you may be asked to provide will vary depending on the credit bureau you’re wanting to get your credit report from, so it’s always a good idea to check with them directly to find out exactly what information they need from you.

In general, though, they’re likely to ask for one, or more, pieces of documentation that identifies you, such as:

- A Driver Licence issued by an Australian state or territory

- Australian passport (current)

- Medicare card issued by Health Insurance Commission

- Credit card or debit card issued by a financial institution in Australia

- Australian Marriage Certificate (Australia Registry issue only)

- Change of Name Certificate (Australian Registry only)

- Full Birth Certificate (not a Birth Certificate extract)

- Centrelink card issued by Centrelink

- Utility bills (e.g. phone, electricity or gas)

3. Set aside some time to fill out the credit report request

The amount of time you’ll need to fill out a credit report application will vary depending on your individual situation and the specific credit reporting agency you’ve decided to use.

In general, however, it shouldn’t take more than 10 to 15 minutes to complete a credit report application. Since all three major credit reporting bureaus have online application forms, you’re likely to get it done quickly and easily – especially if you’ve got all the necessary information on hand.

Is it free to do a credit score check?

Equifax currently offers a free credit report option, subject to eligibility criteria. Find out more HERE.

Experian also offers a free credit report. However, they state that “Free denotes that credit reports will only be provided free of charge once every 3 months.“

Illion mentions the following about their credit report: “It takes a few minutes to sign up, and it’s free.“

How do I do a credit score check?

Now that you’re ready to do your credit score check, let’s have a look at how you can go about it with each of the three major credit reporting bureaus…

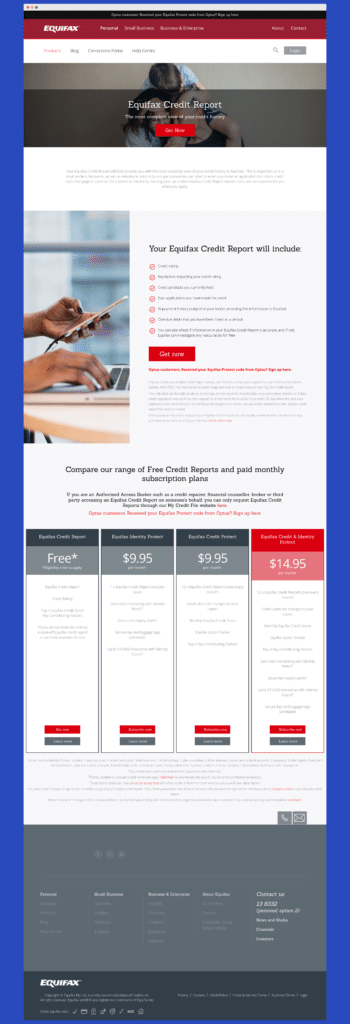

Equifax online credit score check – step by step guide

STEP 1: Go to the following link: https://www.equifax.com.au/personal/products/equifax-credit-report

Scroll down and choose the option on the very left-hand side of the page titled “Equifax Credit Report”.

Then click the “Get now” button.

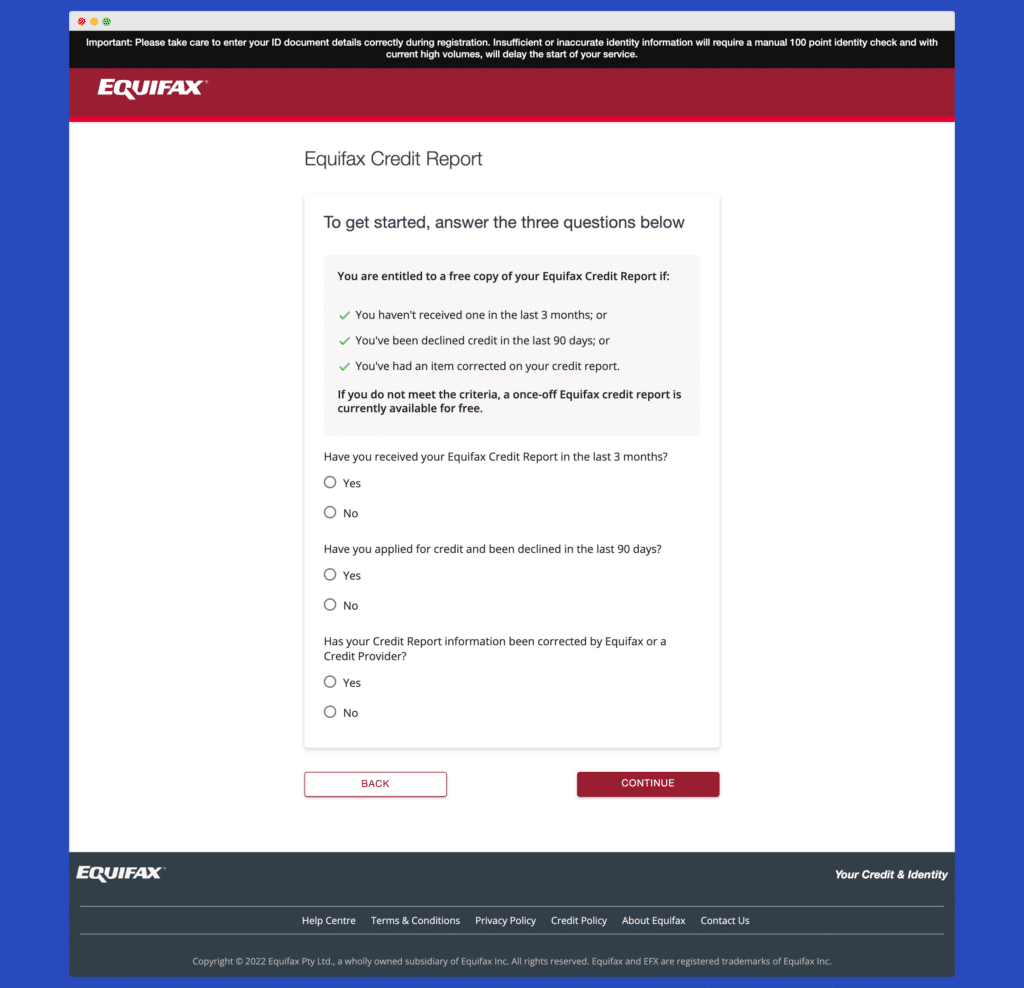

STEP 2: You’ll be taken to the following page to get started.

Answer the three questions and click the “CONTINUE” button.

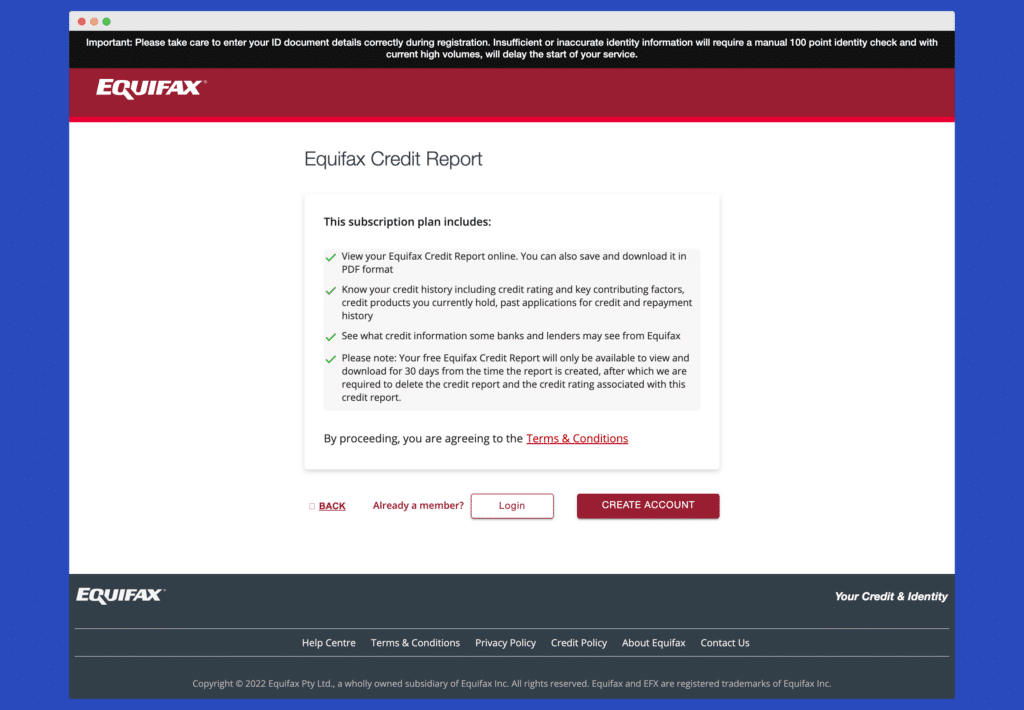

STEP 3: Next, you’ll be taken to the following page to create an account.

If you’re ready to keep going, click the “CREATE ACCOUNT” button.

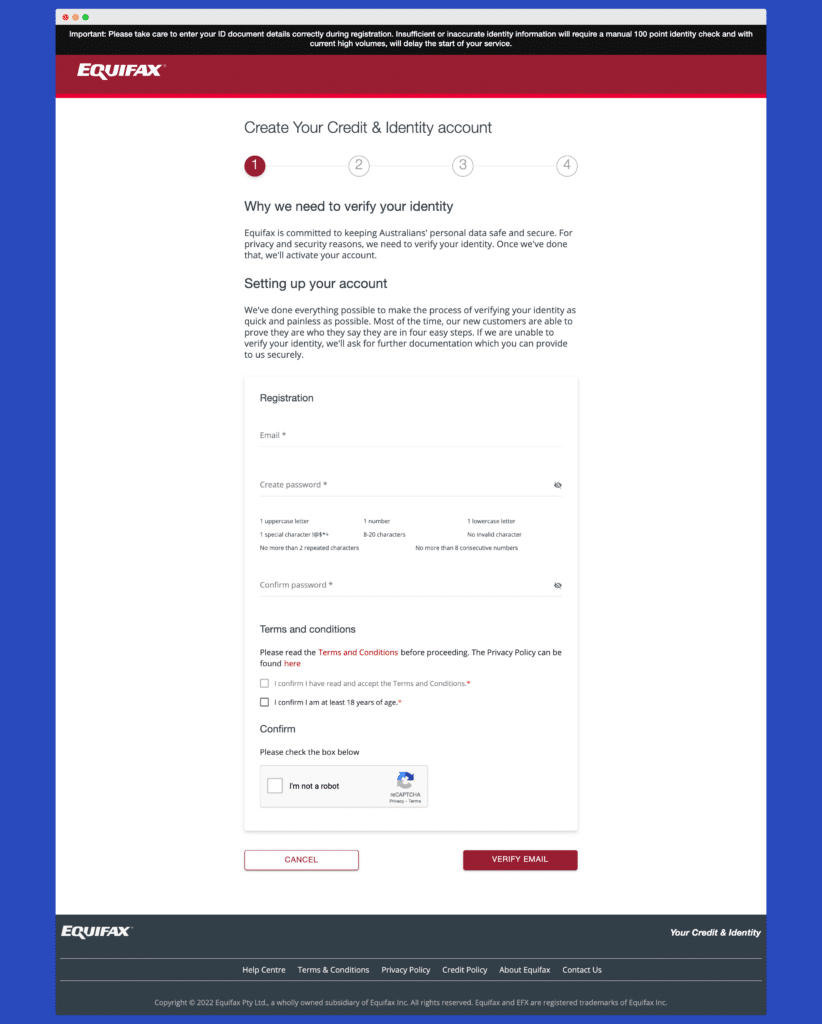

STEP 4: Next, you’ll be asked to complete a registration in order to set up your account.

Fill in the details and click the “VERIFY EMAIL” button to move on to the next step.

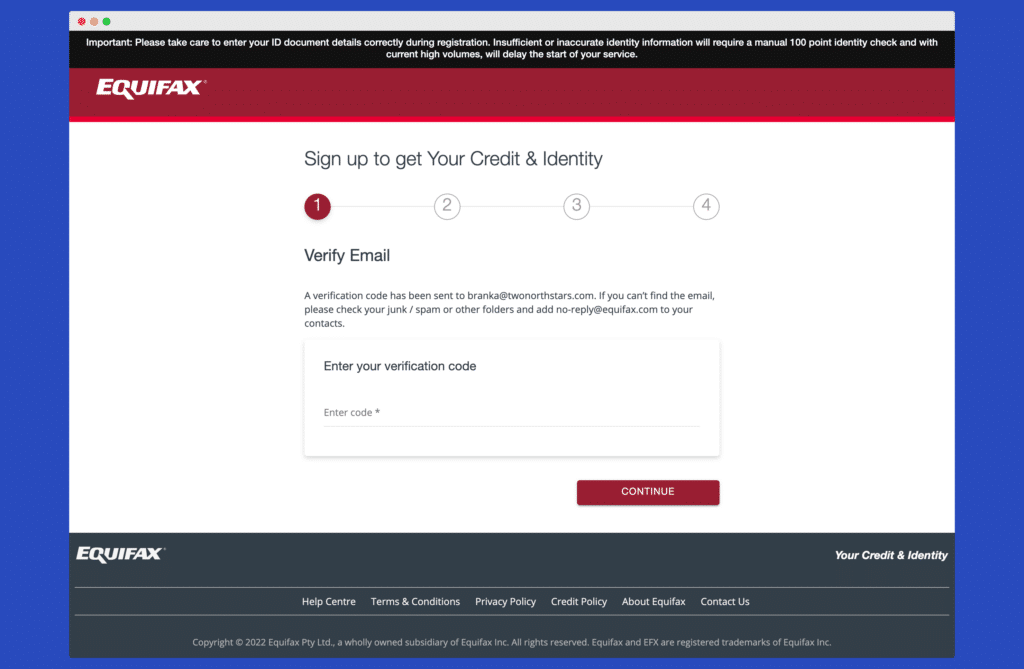

STEP 5: You’ll then be asked to verify your email.

When this happens, you’ll need to go to your email to get the verification code and enter it on this page.

Once you’ve done that, click the “CONTINUE” button.

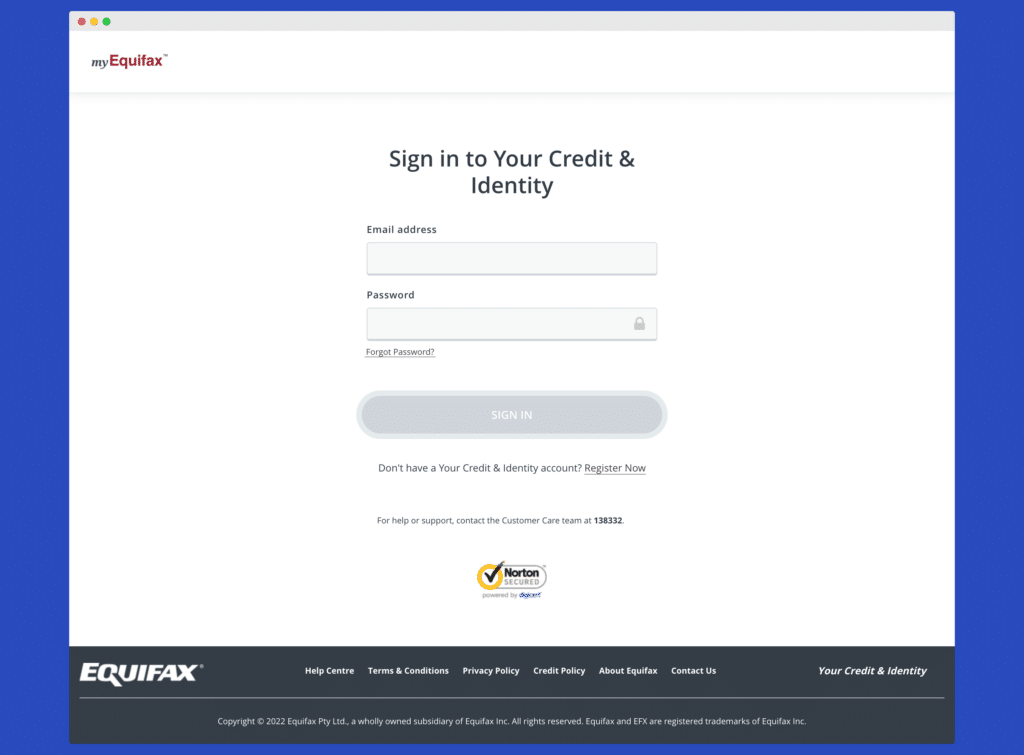

STEP 6: The screen will refresh and you’ll be asked to log into myEquifax using the details that you’ve just set up.

So once you’re ready, pop those details in and click the “SIGN IN” button.

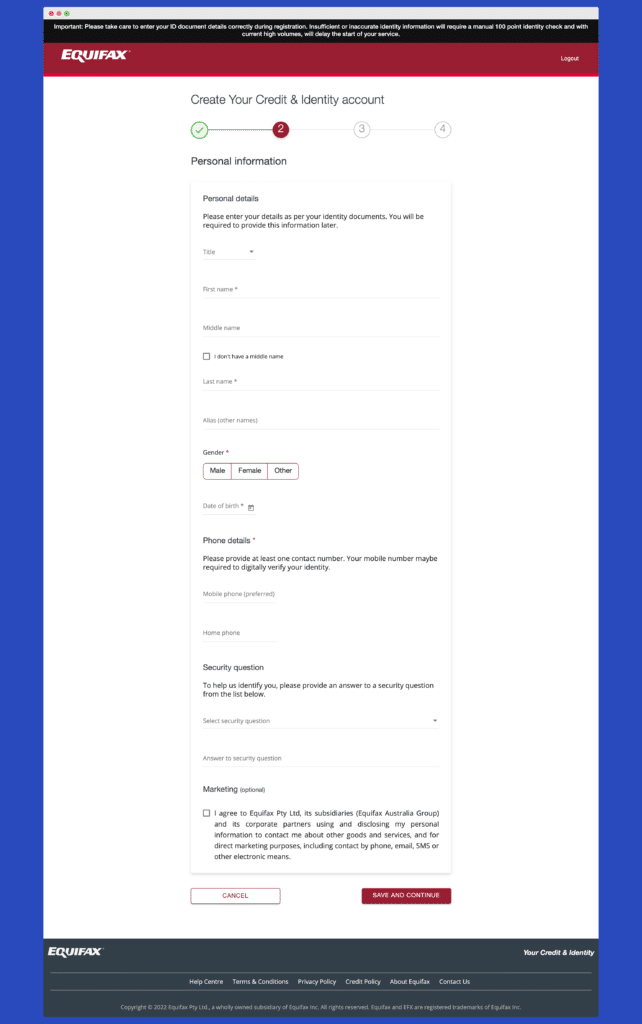

STEP 7: You’re in! But there’s still a few things left to do before you get your credit report.

The first thing you’ll be asked to do is fill in some personal information.

When you’re done, click the “SAVE AND CONTINUE” button.

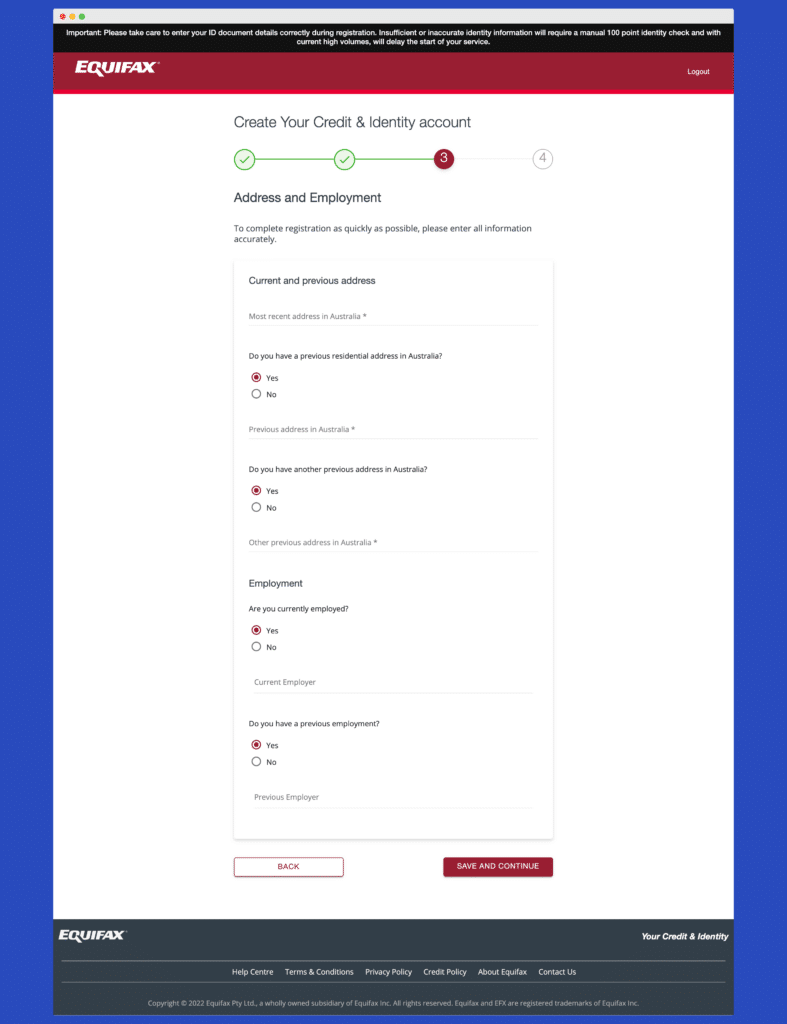

STEP 8: Next, you’ll be asked for address and employment details.

When you’ve filled everything in, click the “SAVE AND CONTINUE” button.

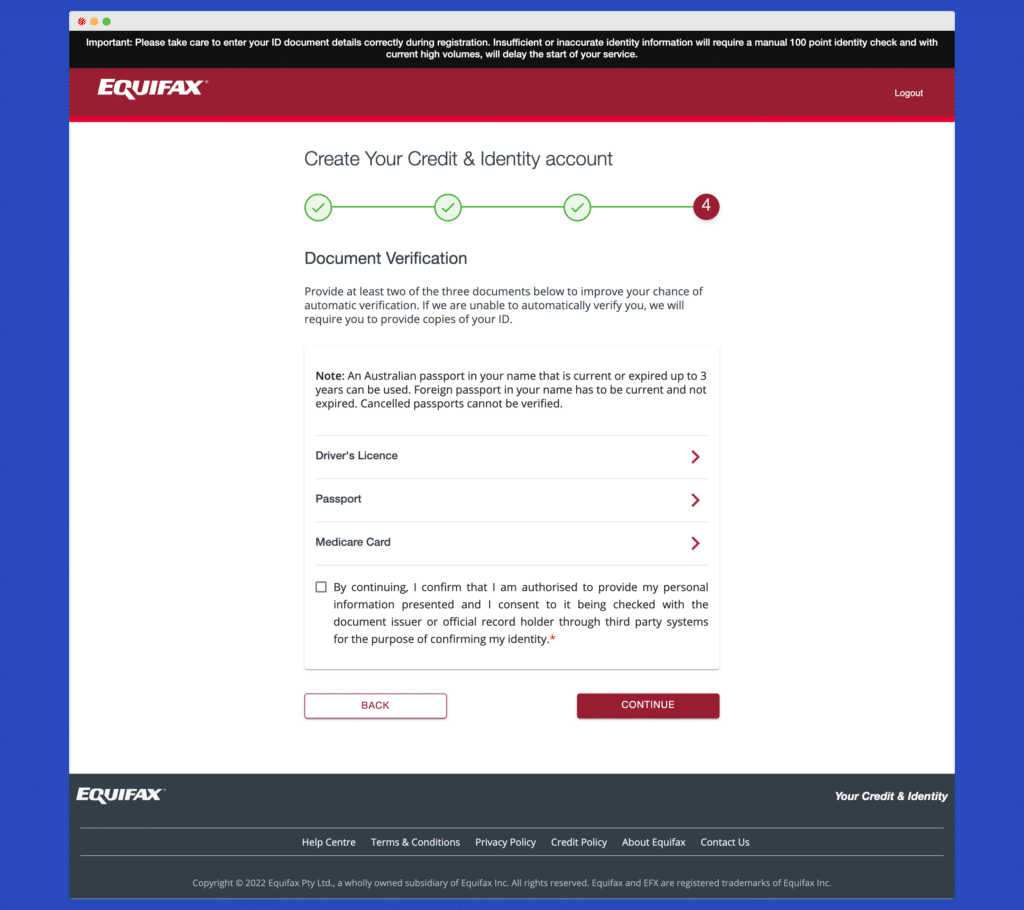

STEP 9: Finally, you’ll need to do document verification.

Choose which suits you from the options provided, fill in the details, and click the “CONTINUE” button.

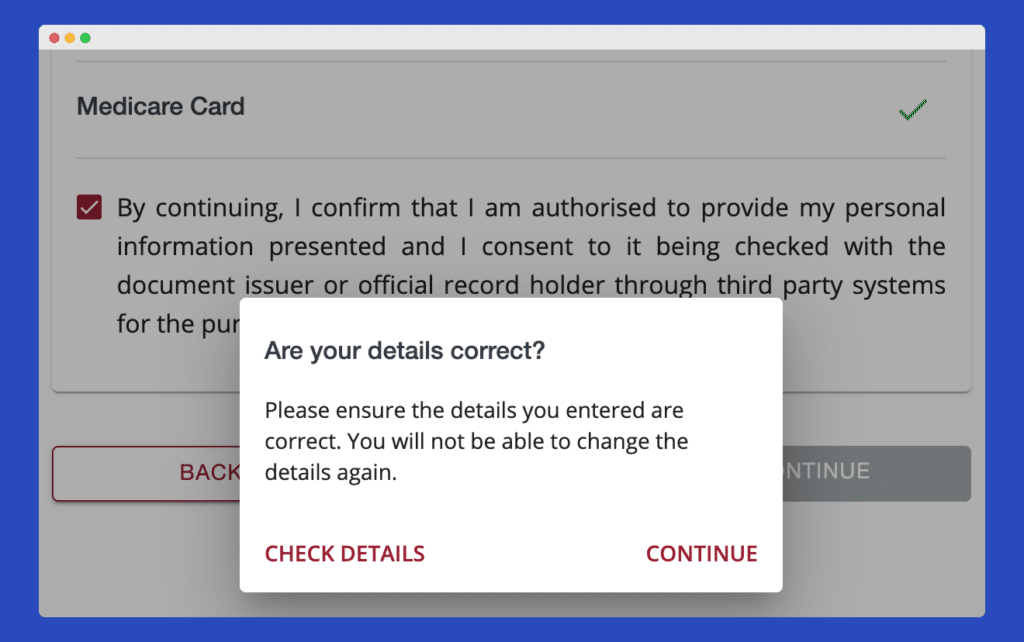

STEP 10: You’ll be prompted to confirm that your details are correct.

If you’re happy with everything simply click the “CONTINUE” button.

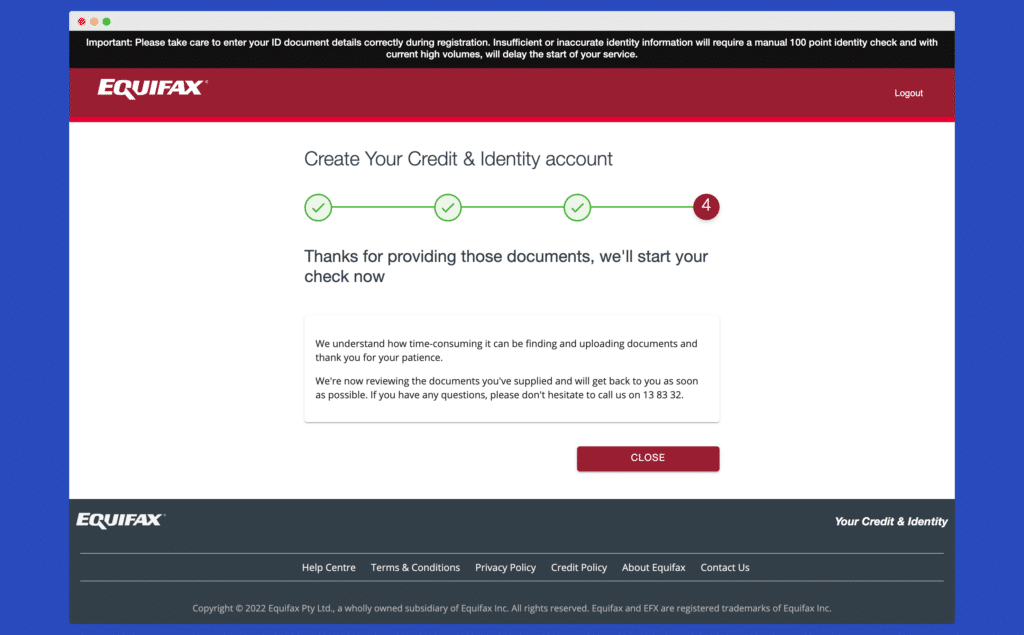

STEP 11: That’s it! You’ve submitted all your details which Equifax will now review.

At this stage you can click the “CLOSE” button and keep an eye on your email inbox (also make sure to check your Spam folder as important emails can sometimes get lost there).

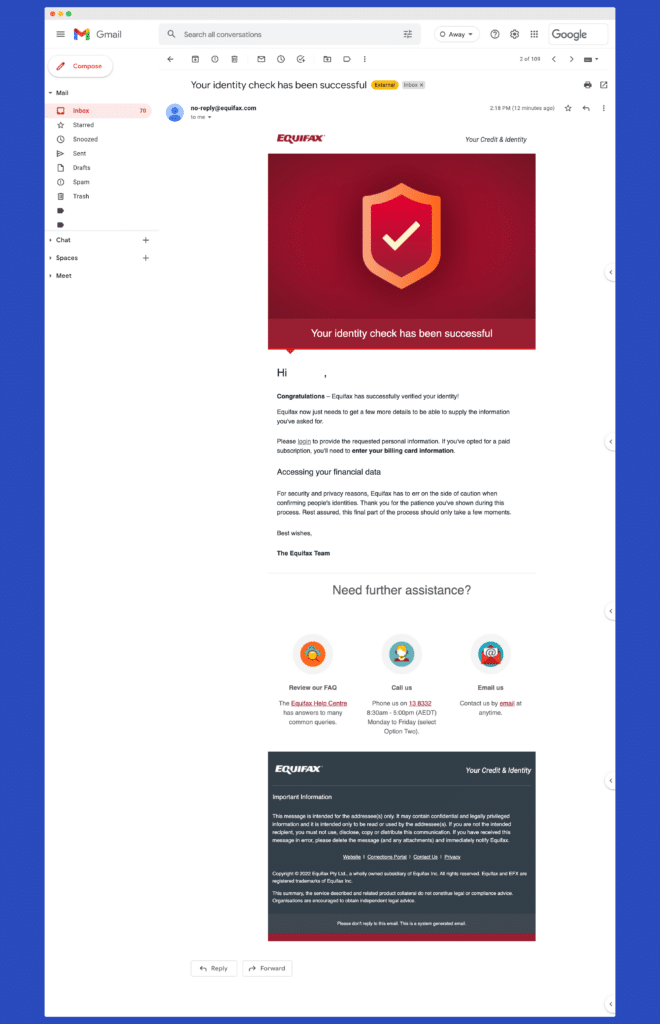

STEP 11a: If everything is OK with your documentation, you’ll get an email from Equifax letting you know they’ve successfully verified your identification.

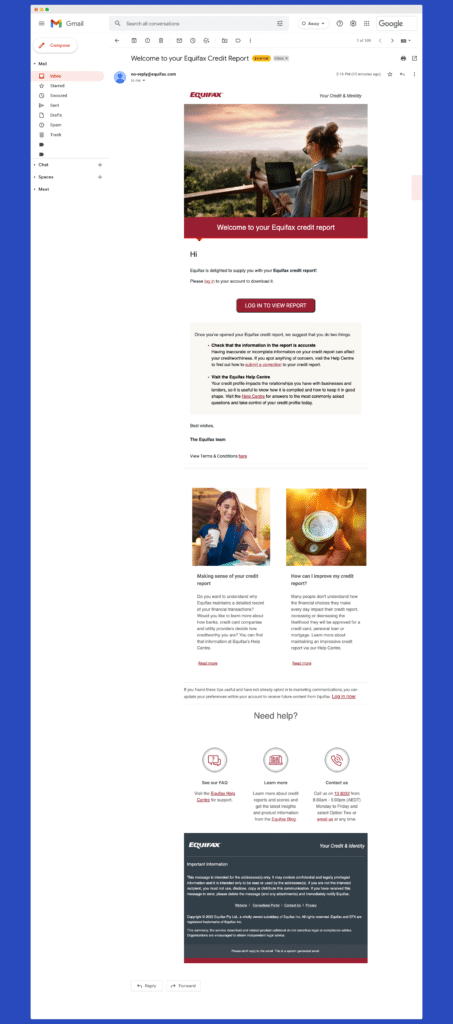

STEP 12: Shortly after the first email confirming that your identity has been verified, you should also get a second email letting you know your Equifax Credit Report is ready.

Click the “LOG IN TO VIEW REPORT” button to head back to myEquifax and log in.

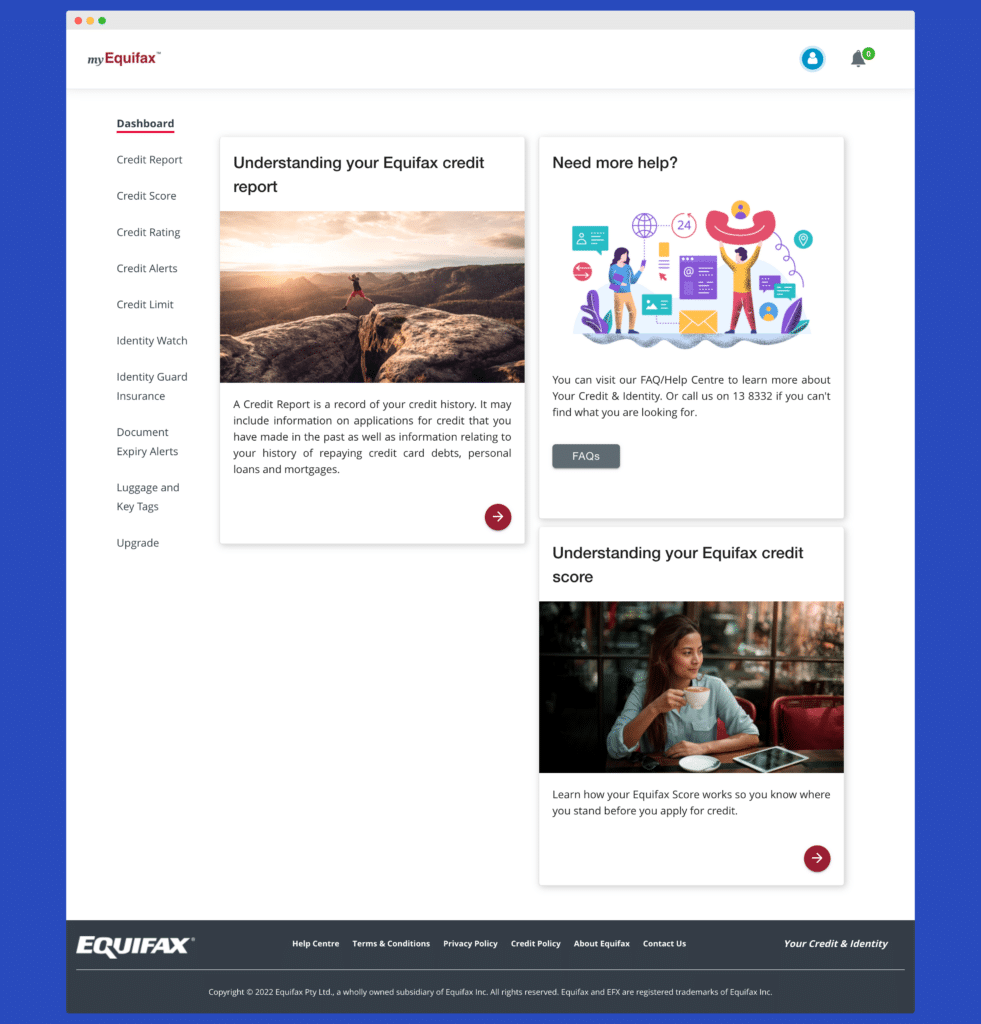

STEP 13: Log into myEquifax and on the left-hand side under “Dashboard” you’ll see a menu item titled “Credit Report”. Click that menu item to be taken to that page.

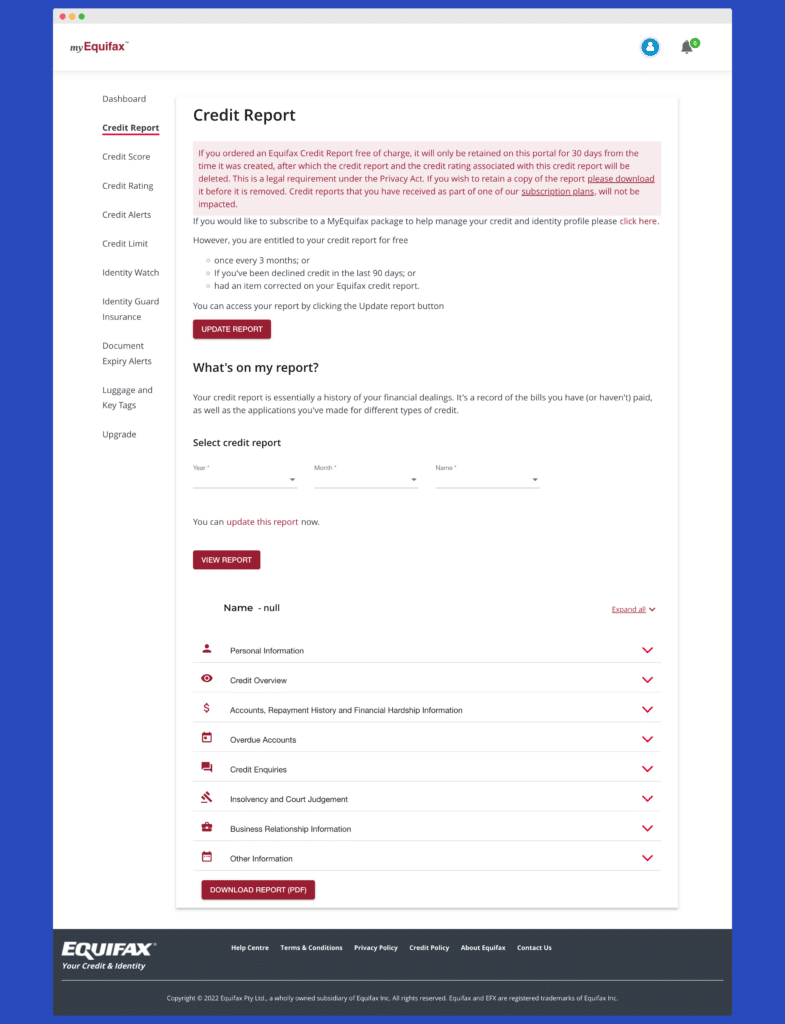

STEP 14: In the “Credit Report” section you’ll have the option to select which credit report you’d like to view. Once you’ve done this, you can then download that report using the “DOWNLOAD REPORT (PDF)” button.

Experian online credit score check – step by step guide

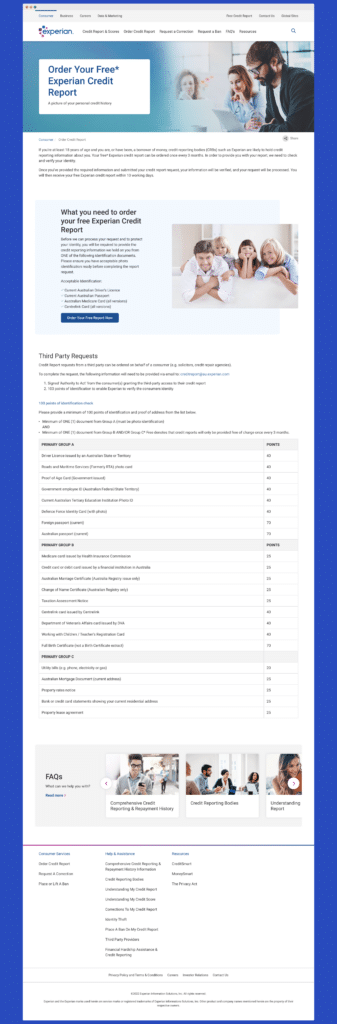

STEP 1: Go to the following link: https://www.experian.com.au/consumer/order-credit-report

Scroll down to the section with the heading “What you need to order your free Experian Credit Report” and click the “Order Your Free Report Now” button.

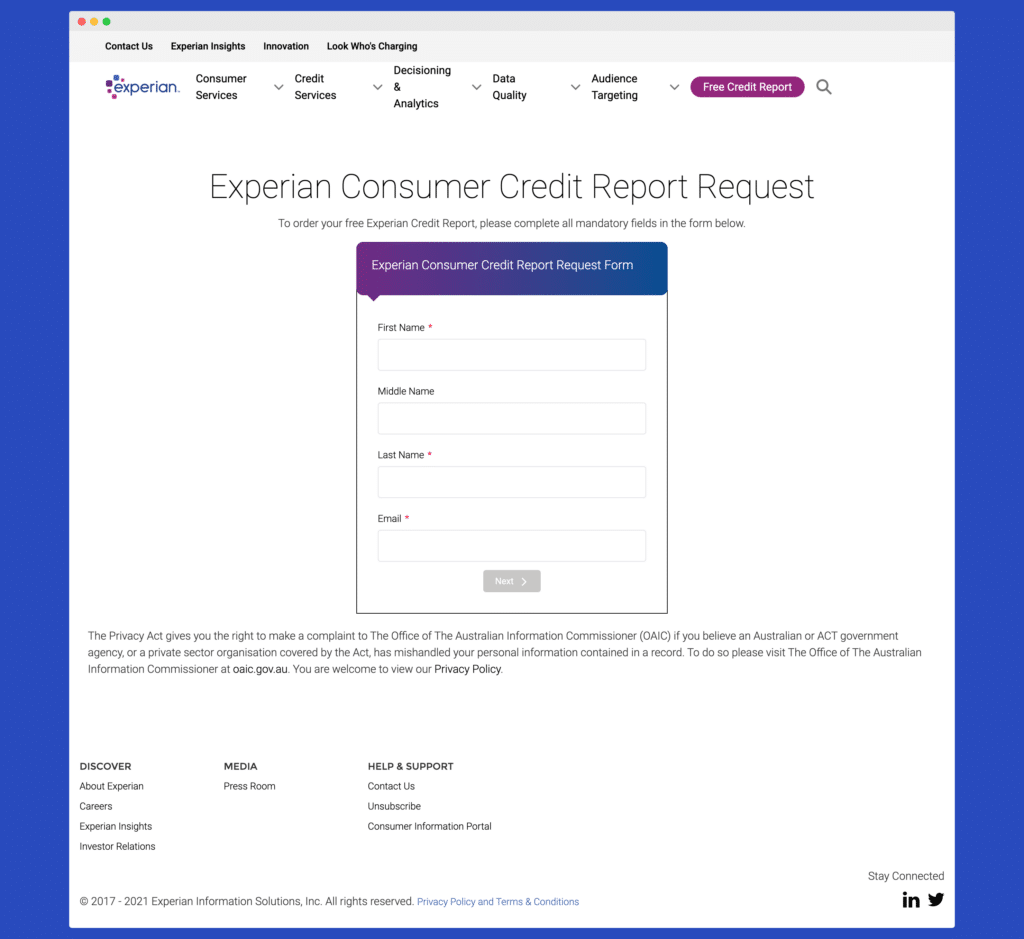

STEP 2: You’ll be taken to the following page to get started.

Fill in the required details and click the “Next” button.

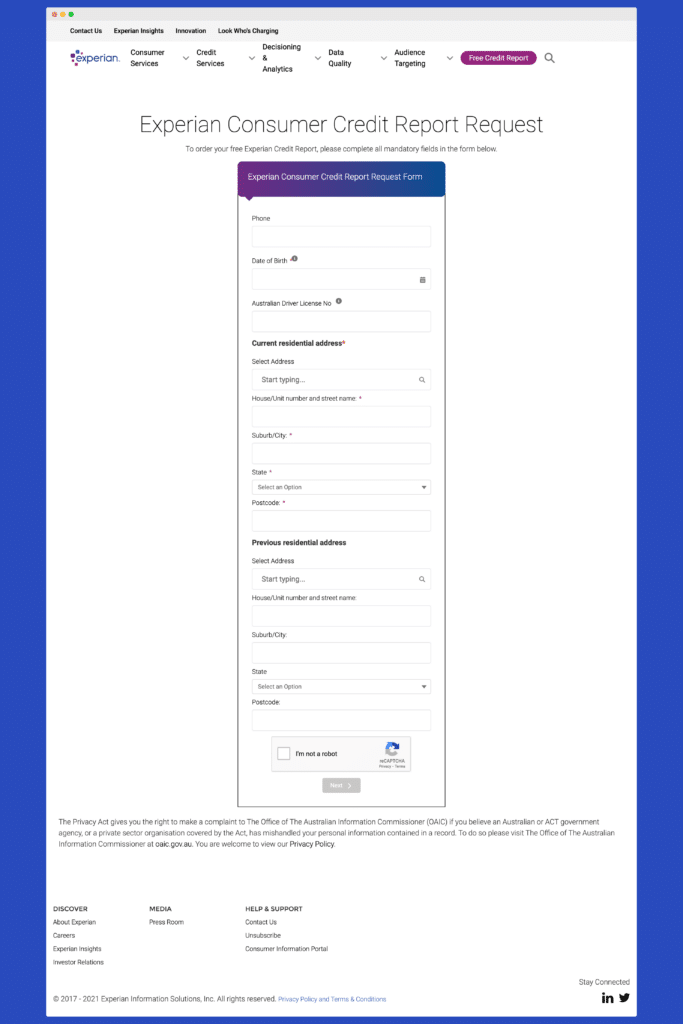

STEP 3: Next, you’ll be asked to fill in some personal information. Fill in the required details and click the “Next” button.

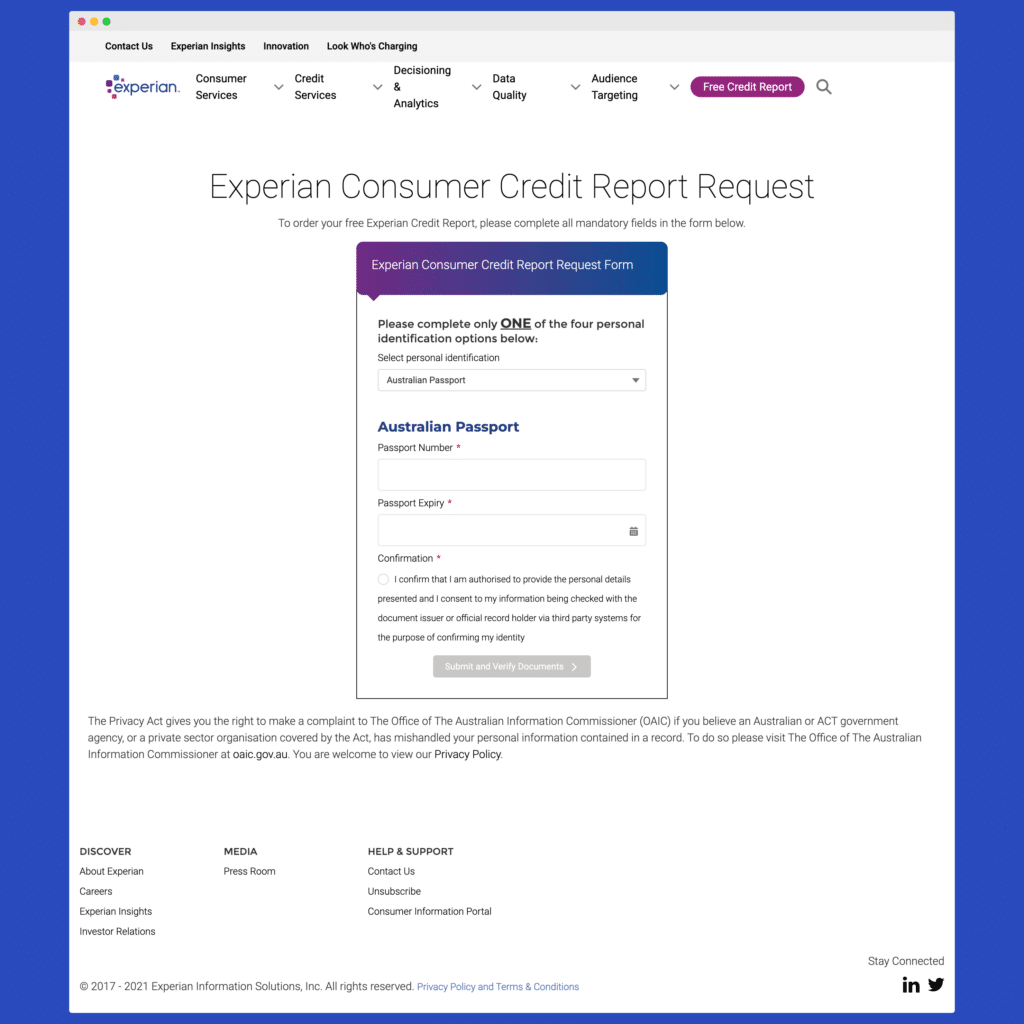

STEP 4: You’ll then be asked to do an ID check.

Choose from one of the four personal identification options provided, fill in the details, and click the “Submit and Verify Documents” button.

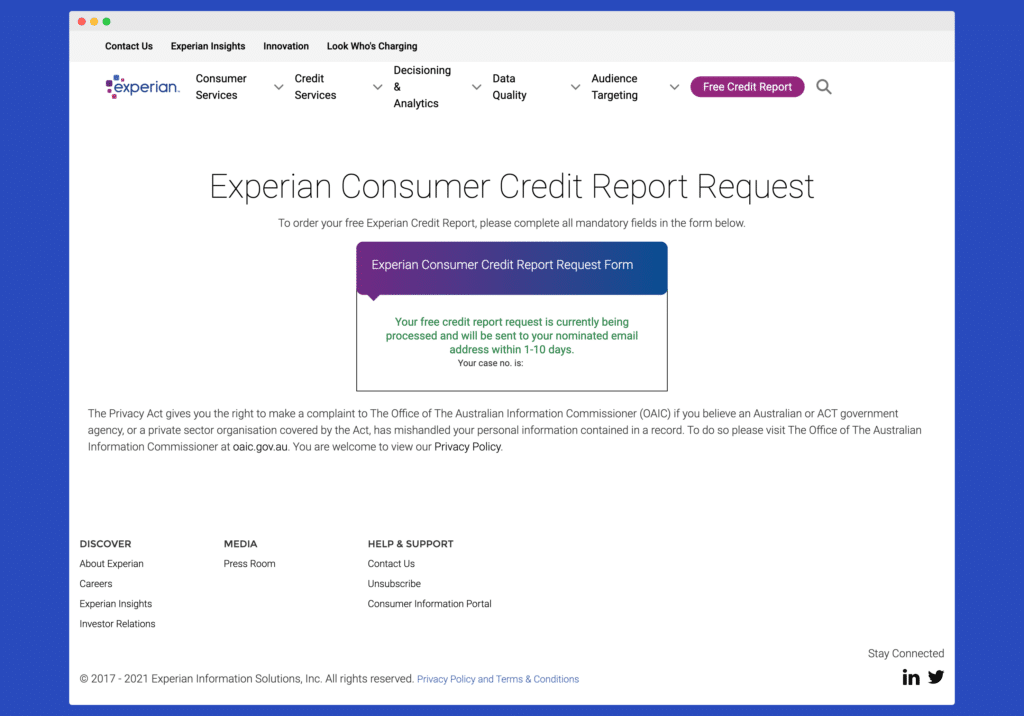

STEP 5: You’ll see a notification letting you know that your request is being processed. This notification will also include a case number.

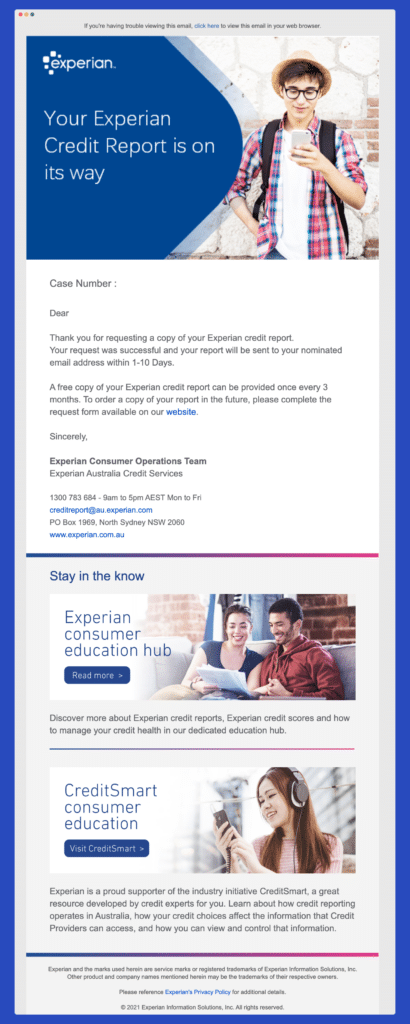

STEP 6: If everything is OK with your documentation, you’ll get an email letting you know that your credit report will be sent to your nominated email address within 1-10 days.

Once your Experian Credit Report arrives in your inbox, it’ll come as a password protected PDF document (with password instructions) and it’ll be accompanied by a “How to read your credit report guide” also attached in the email as a PDF.

Illion online credit score check – step by step guide

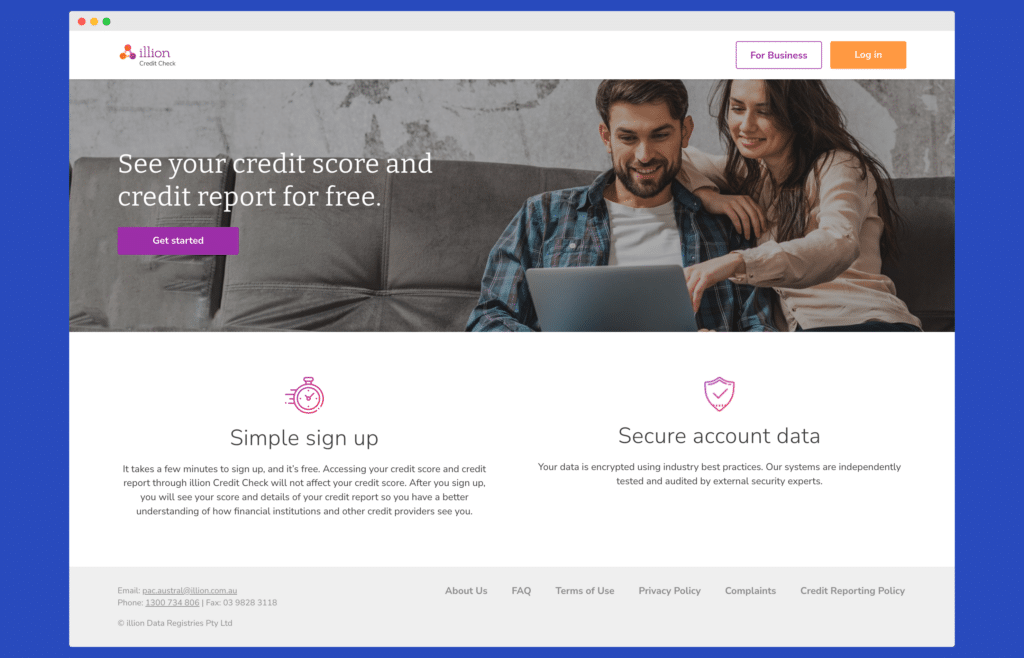

STEP 1: Go to the following link: https://www.creditcheck.illion.com.au/

Then click the “Get started” button in the main section at the top.

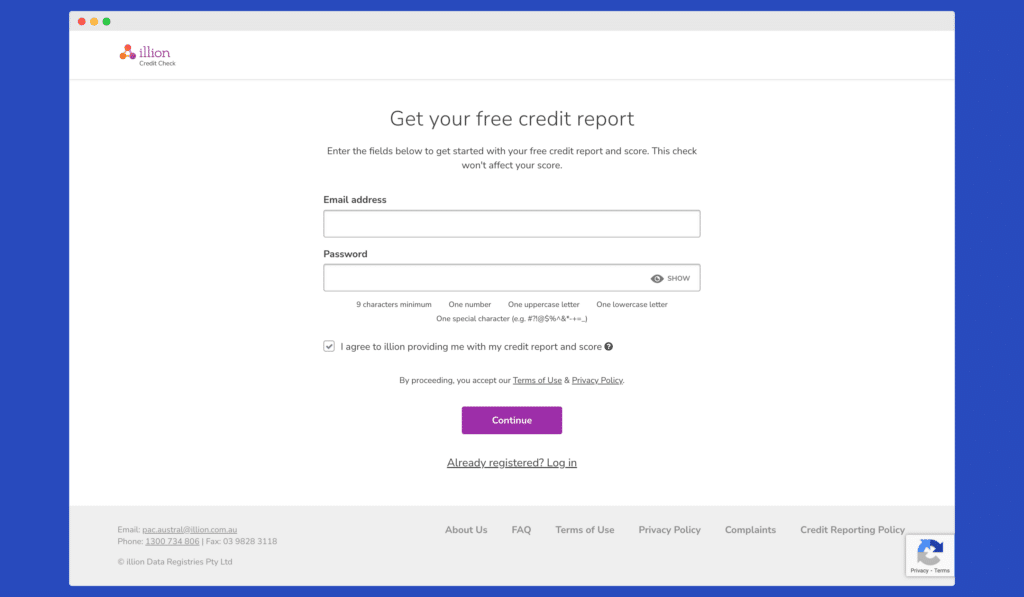

STEP 2: You’ll be taken to the following page to get started.

Put in your email address, create a password, and click the “Continue” button.

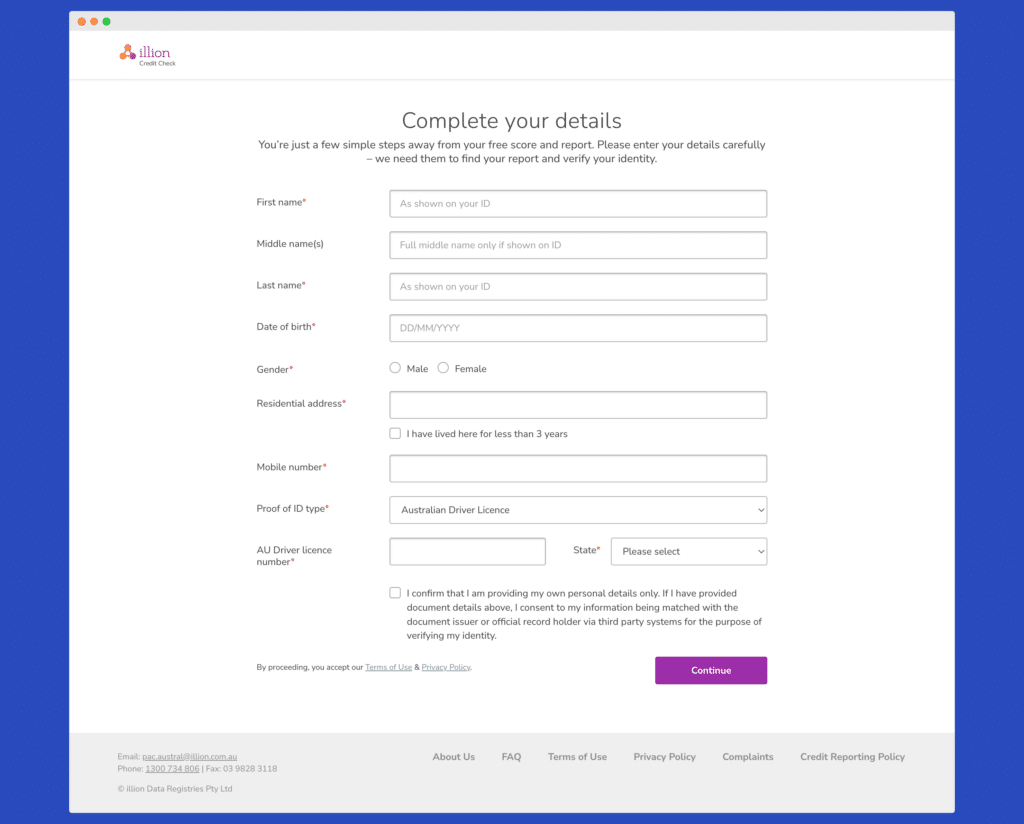

STEP 3a: You’ll be asked to complete some personal details, including verifying your identity.

Once you’ve filled everything in, click the “Continue” button.

STEP 3b: Illion will then let you know that your membership is being created.

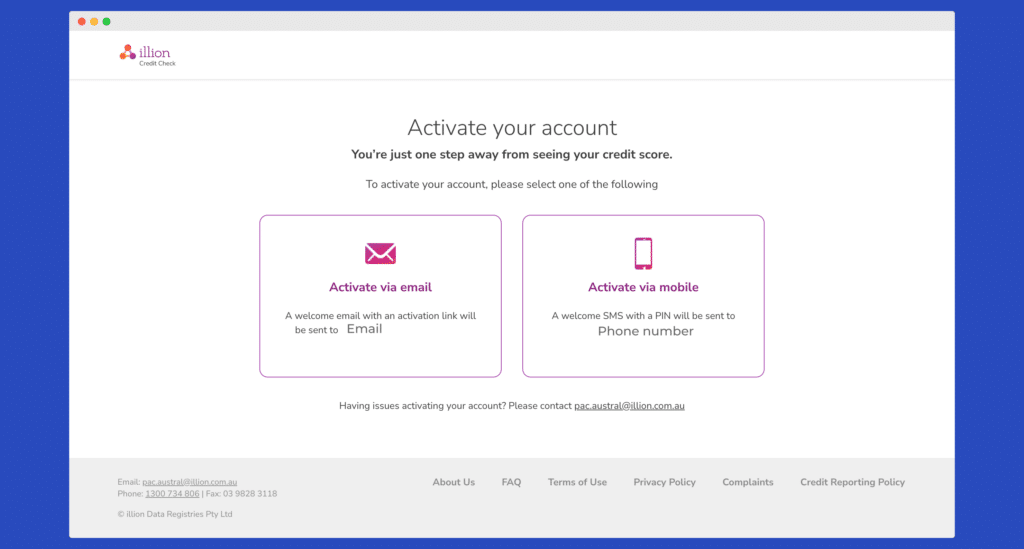

STEP 4: Next, you’ll be asked to activate your account via either your email or mobile phone.

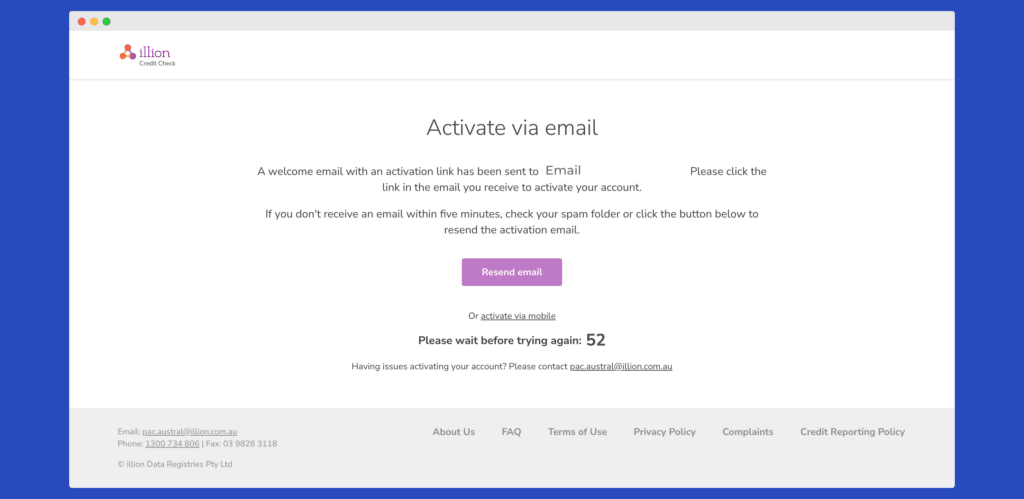

STEP 5: Follow the instructions sent to your preferred method of communication to activate your account.

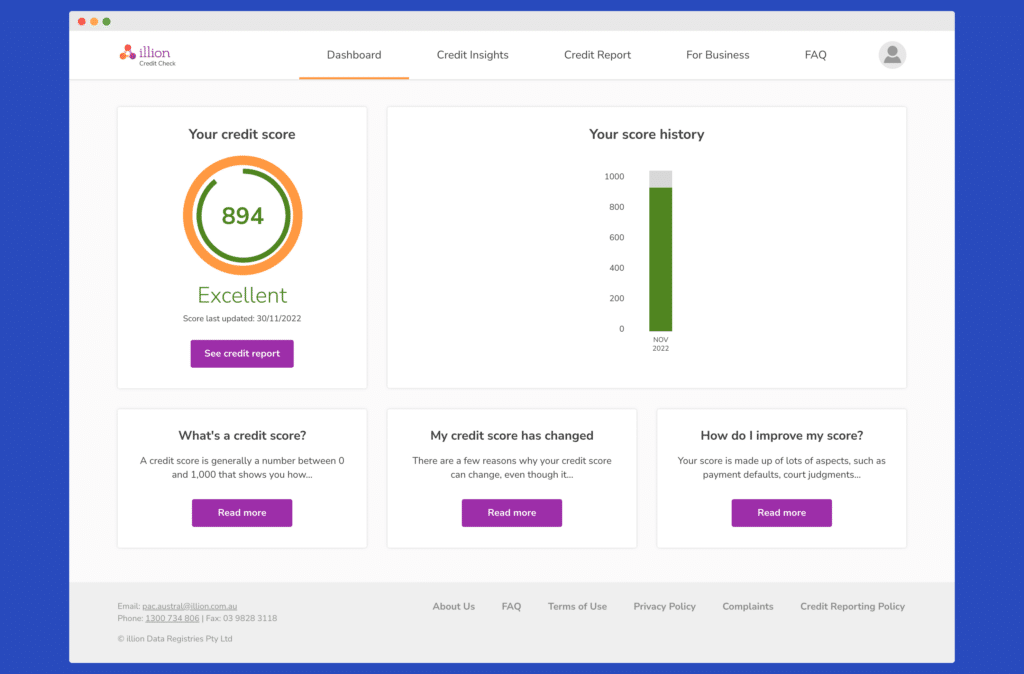

STEP 6: Once you’ve successfully activated your account you’ll be logged into your Illion Dashboard where you’ll be able to see your credit score on the left-hand side.

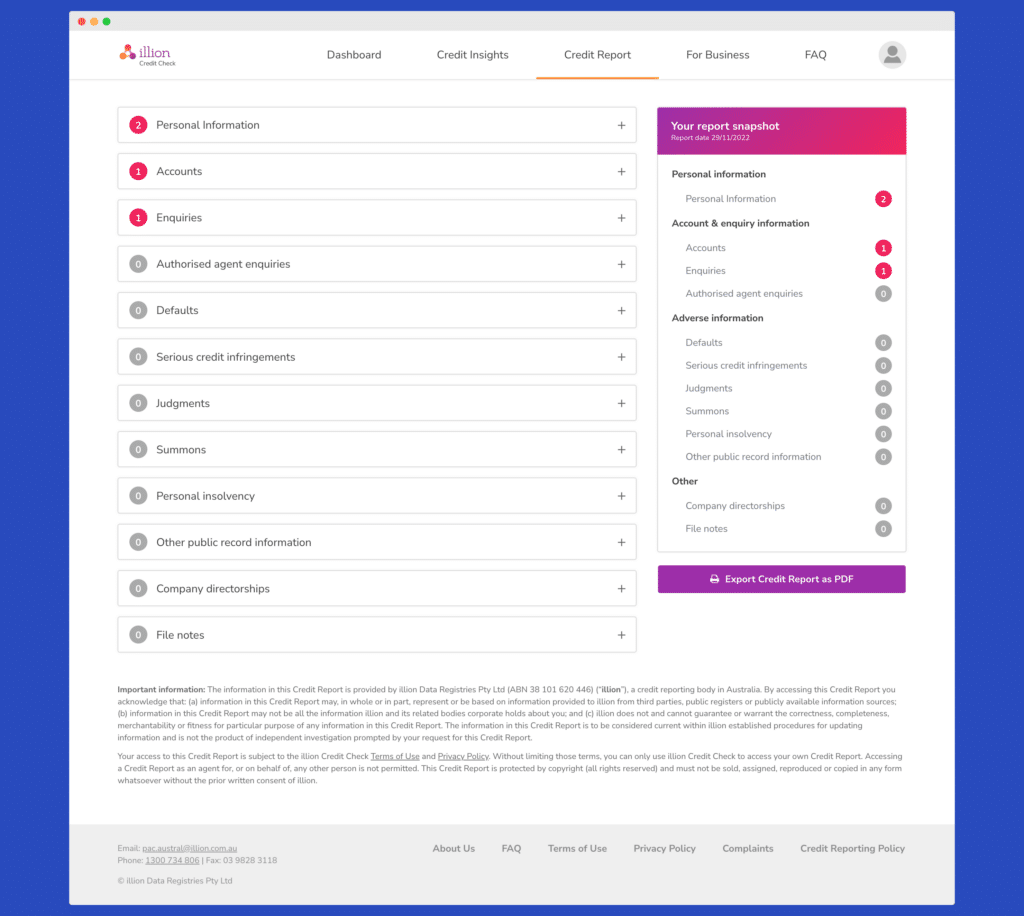

Click the “See credit report” button underneath your credit score to go to the Credit Report section.

STEP 7: Once you’re in the Credit Report section you’ll see an option on the right-hand side of the screen to download your credit report. If you’d like to do this, simply click the “Export Credit Report as PDF” button and you’re done.

What if I’m not happy after my credit score check – how do I improve my credit score?

If you’ve requested your credit report from one (or all) of the credit reporting bureaus – you may not be satisfied with where your score currently stands.If this is the case, here are some of the things you can do to improve your credit score:

Make repayments on time

As mentioned earlier, your payment history is a big factor in your credit score. For some people, it’s the most important factor. That’s why it’s crucial to ensure you make your repayments on time to help you improve your credit score.

Space out your applications for credit

Lenders look at your credit report when you apply for credit with them. This registers as a hard enquiry that shows on your report. If you’ve got multiple applications within a short amount of time, lenders and credit providers looking at your report might think you’re experiencing financial difficulty and reject you for a loan. That’s why spacing out your credit applications can work in your favour.

Where appropriate, keep credit accounts open

The length of your credit history is a factor in determining your credit score. The longer you’ve had a credit account open, the more data there is to use to calculate your credit score – especially if it demonstrates that you can consistently handle a line of credit. So, where appropriate, and where it doesn’t cause you any financial distress, consider keeping the credit account open.

It’s worth noting, however, that it may take a few years to rebuild a credit score. But dedicating your focus to it, and working on it consistently, can have a lot of positive impact.

For more information, you can also check out our detailed guide on how to improve your credit score.

Disclaimer: The information contained in this article is general in nature and does not take into account your personal objectives, financial situation or needs. Therefore, you should consider whether the information is appropriate to your circumstance before acting on it, and where appropriate, seek professional advice from a finance professional such as an adviser.